Real Estate Tax Deduction 2021 . Can i deduct my property taxes? Property tax is payable yearly. The property tax deduction is great for homeowners. The tcja instituted a cap on the deduction for state and. 1 jan 2024 to 31 dec 2024. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. When and how do i pay property tax? Deductible real property taxes include any state or local taxes based on the value of. Again, the answer is yes and no. State and local real property taxes are generally deductible. Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. Scenario and type of property tax relief. At the end of each year, you will receive your property tax bill.

from www.houseloanblog.net

Deductible real property taxes include any state or local taxes based on the value of. Property tax is payable yearly. The property tax deduction is great for homeowners. State and local real property taxes are generally deductible. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. 1 jan 2024 to 31 dec 2024. When and how do i pay property tax? Can i deduct my property taxes? At the end of each year, you will receive your property tax bill. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare.

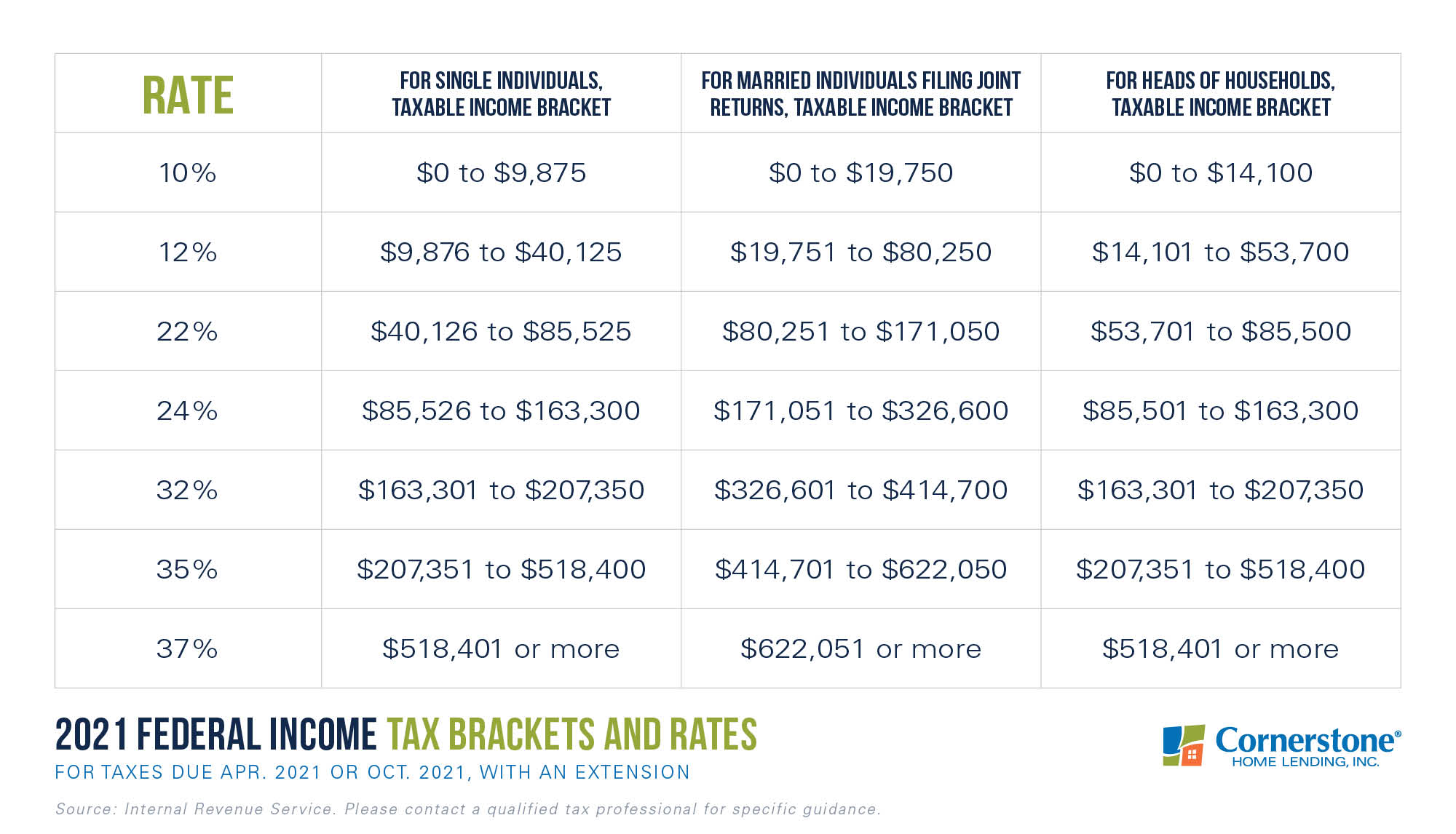

2021 tax deductions Cornerstone Blog

Real Estate Tax Deduction 2021 State and local real property taxes are generally deductible. At the end of each year, you will receive your property tax bill. 1 jan 2024 to 31 dec 2024. Again, the answer is yes and no. Property tax is payable yearly. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. Can i deduct my property taxes? Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each. State and local real property taxes are generally deductible. The property tax deduction is great for homeowners. Scenario and type of property tax relief. When and how do i pay property tax? Deductible real property taxes include any state or local taxes based on the value of. The tcja instituted a cap on the deduction for state and.

From www.pdffiller.com

Standard Deduction Line Fill Online, Printable, Fillable, Blank Real Estate Tax Deduction 2021 Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Property tax is payable yearly. At the end of each year, you will receive your property tax bill. Again, the answer is yes and no. Deductible real property taxes include any state or local taxes based on the value of.. Real Estate Tax Deduction 2021.

From standard-deduction.com

Can You Claim Standard Deduction And Itemized/page/2 Standard Real Estate Tax Deduction 2021 Again, the answer is yes and no. When and how do i pay property tax? 1 jan 2024 to 31 dec 2024. State and local real property taxes are generally deductible. Can i deduct my property taxes? The tcja instituted a cap on the deduction for state and. Deductible real property taxes include any state or local taxes based on. Real Estate Tax Deduction 2021.

From www.youtube.com

Rental Property Tax Deductions 2021 Investing For Beginners YouTube Real Estate Tax Deduction 2021 When and how do i pay property tax? Scenario and type of property tax relief. The property tax deduction is great for homeowners. Property tax is payable yearly. Deductible real property taxes include any state or local taxes based on the value of. Deductible real property taxes are generally any state or local taxes on real property levied for the. Real Estate Tax Deduction 2021.

From standard-deduction.com

Standard Deduction U/s 16(ia) For Ay 202122 Standard Deduction 2021 Real Estate Tax Deduction 2021 Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each. When and how do i pay property tax? The property tax deduction is great for homeowners. Again, the answer is yes and no. Deductible real property taxes are generally any state or local taxes on. Real Estate Tax Deduction 2021.

From worksheets.clipart-library.com

Standard Deduction 2021 Complete with ease airSlate SignNow Real Estate Tax Deduction 2021 At the end of each year, you will receive your property tax bill. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. 1 jan 2024 to 31 dec 2024. State and local real property taxes are generally deductible. Property tax is payable yearly. Can i deduct my property taxes?. Real Estate Tax Deduction 2021.

From www.aimmachines.com

DEDUCT IN 2020, PAY IN 2021! AIM Machines Real Estate Tax Deduction 2021 Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. Again, the answer is yes and no. The property tax deduction is great for homeowners. Deductible real property taxes include any state or local taxes based on the value of. Property tax is payable yearly. 1 jan 2024 to 31. Real Estate Tax Deduction 2021.

From livesouthfloridarealty.com

Comparison of Real Estate Taxes for 2021 Live South Florida Realty, Inc. Real Estate Tax Deduction 2021 Again, the answer is yes and no. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. At the end of each year, you will receive your property tax bill. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.. Real Estate Tax Deduction 2021.

From standard-deduction.com

Standard Deduction 2020 Vs Itemized Standard Deduction 2021 Real Estate Tax Deduction 2021 Property tax is payable yearly. Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each. Scenario and type of property tax relief. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. At the end. Real Estate Tax Deduction 2021.

From lyfeaccounting.com

Best Tax Breaks 12 MostOverlooked Tax Breaks & Deductions (2021) Real Estate Tax Deduction 2021 Property tax is payable yearly. Can i deduct my property taxes? Again, the answer is yes and no. The tcja instituted a cap on the deduction for state and. Scenario and type of property tax relief. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. State and local real. Real Estate Tax Deduction 2021.

From standard-deduction.com

Standard Deduction For 2021 Taxes Standard Deduction 2020 & 2021 Real Estate Tax Deduction 2021 The property tax deduction is great for homeowners. The tcja instituted a cap on the deduction for state and. Deductible real property taxes include any state or local taxes based on the value of. Property tax is payable yearly. Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property. Real Estate Tax Deduction 2021.

From midwestcommunity.org

5 Tax Deductions and Credits to Consider During the 2021 Tax Season Real Estate Tax Deduction 2021 Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each. Can i deduct my property taxes? At the end of each year, you will receive. Real Estate Tax Deduction 2021.

From www.pinterest.com

IRS Releases Key 2021 Tax Information standarddeduction2021 Real Estate Tax Deduction 2021 The property tax deduction is great for homeowners. Deductible real property taxes include any state or local taxes based on the value of. At the end of each year, you will receive your property tax bill. Can i deduct my property taxes? Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax. Real Estate Tax Deduction 2021.

From zweigaccounting.com

Zweig Accountancy Corporation IRS Releases 2021 InflationAdjusted Real Estate Tax Deduction 2021 The tcja instituted a cap on the deduction for state and. At the end of each year, you will receive your property tax bill. Real estate taxes are usually divided so that you and the seller each pay taxes for the part of the property tax year that each. Scenario and type of property tax relief. 1 jan 2024 to. Real Estate Tax Deduction 2021.

From www.tictoclife.com

Beating the Standard Deduction with Strategic Giving Real Estate Tax Deduction 2021 Again, the answer is yes and no. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare. Can i deduct my property taxes? Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. State and local real property taxes are. Real Estate Tax Deduction 2021.

From www.biggerpockets.com

Tax Deductions & Advice for Real Estate Investors [2021] Real Estate Tax Deduction 2021 At the end of each year, you will receive your property tax bill. The property tax deduction is great for homeowners. Property tax is payable yearly. State and local real property taxes are generally deductible. 1 jan 2024 to 31 dec 2024. Can i deduct my property taxes? The tcja instituted a cap on the deduction for state and. Deductible. Real Estate Tax Deduction 2021.

From www.purposefulfinance.org

IRS 2021 Tax Tables, Deductions, & Exemptions — purposeful.finance Real Estate Tax Deduction 2021 Again, the answer is yes and no. When and how do i pay property tax? State and local real property taxes are generally deductible. 1 jan 2024 to 31 dec 2024. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Deductible real property taxes include any state or local. Real Estate Tax Deduction 2021.

From www.irs.gov

Instructions for Form 8995 (2023) Internal Revenue Service Real Estate Tax Deduction 2021 When and how do i pay property tax? At the end of each year, you will receive your property tax bill. 1 jan 2024 to 31 dec 2024. Property tax is payable yearly. Scenario and type of property tax relief. Again, the answer is yes and no. State and local real property taxes are generally deductible. The tcja instituted a. Real Estate Tax Deduction 2021.

From www.aditi.du.ac.in

Real Estate Agent Tax Deductions Worksheet 2022 Fill, 12/21/2023 Real Estate Tax Deduction 2021 Deductible real property taxes include any state or local taxes based on the value of. Property tax is payable yearly. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Deductible real property taxes are generally any state or local taxes on real property levied for the general public welfare.. Real Estate Tax Deduction 2021.